Consumer Inflation Moves Higher

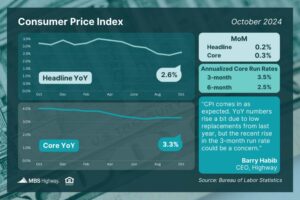

The latest Consumer Price Index (CPI) showed that inflation rose 0.2% in October, with the annual reading coming in at 2.6%.While this was an uptick from the 2.4% 12-month rate seen in September, it was in line with what economists had forecasted.

The core measure, which strips out volatile food and energy prices, increased 0.3% from September while the annual reading held steady at 3.3%. These figures also met expectations.

What’s the bottom line? The Fed began aggressively hiking their benchmark Fed Funds Rate (the overnight borrowing rate for banks) in March 2022 to try to slow the economy and curb the runaway inflation that became rampant after the pandemic. More recently, cooling consumer inflation and rising unemployment caused the Fed to start cutting the Fed Funds Rate, first by 50basis points at their meeting in September. A 25-basis point cut followed on November 7.

And while we have seen significant progress since inflation peaked in 2022, when Headline CPI hit 9.1% and Core CPI hit 6.6%,we are seeing an acceleration in the recent rate of change. For example, if we annualize the last six months of readings, the year-over-year rate of inflation for Core CPI would be 2.5%, while annualizing the last three months gives us a rate of 3.5%.

In a speech last week, Fed Chair Jerome Powell noted that “the economy is not sending any signals that we need to be in a hurry to lower rates.” He added that the Fed will “carefully assess incoming data, the evolving outlook, and the balance of risks” as members consider the timing for further rate cuts.

With the Fed’s next meeting on December 18, key inflation reports to look for include the next Personal Consumption Expenditures (November 27) and Consumer Price Index (December 11). On the labor front, November’s Jobs Report (December6) will also be pivotal.